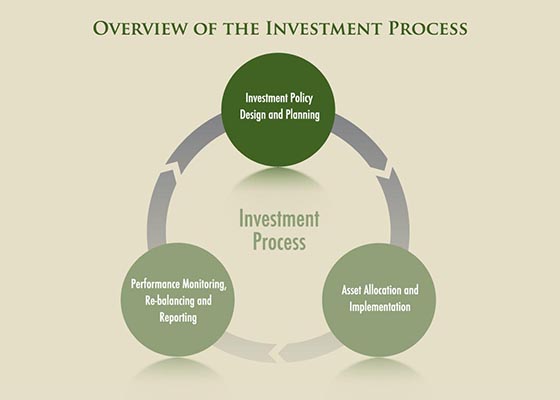

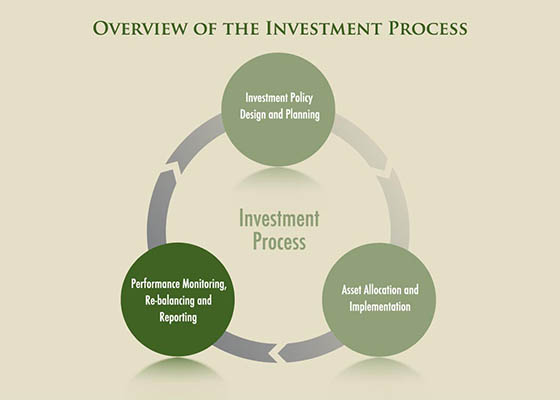

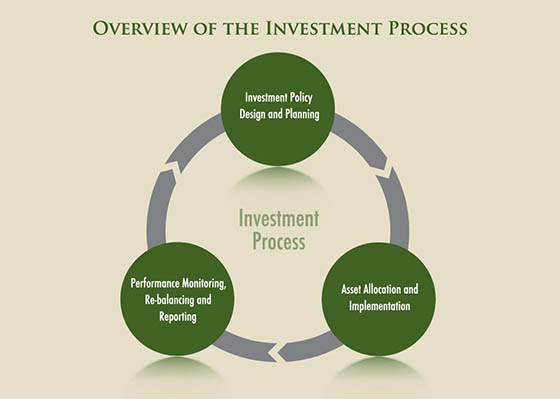

Our Approach and Philosophy

A disciplined approach to investment management is the best approach for investors over the longer-term. Most successful portfolios also have refined goals clearly articulated in a Policy Statement, with investments implemented and monitored by a professional.

The cornerstone of durable portfolio construction is the development of a well reasoned and realistic Investment Policy that clarifies objectives, resources, and a core strategy. This Policy provides the basis for evaluating and selecting investments as well as establishing standards of risk, performance and administration. Using this Policy as a blue print, Upland then builds a tailored investment program using a broad mix of both traditional and alternative investment proxies.

Investment Policy Design

and Planning

A

well-reasoned plan that clarifies and balances resources, articulates

objectives, and focuses on risk tolerances and performance expectations.

It is essential to bevable to evaluate new investment opportunities

Design and Planning

or procedures in the context of an individualized investment policy.

Performance Monitoring,

Re-balancing and Reporting

The investment process is a continual one of setting

objectives, implementing strategies, monitoring

results and reassessing where appropriate.

Asset Allocation and

Implementation

Asset allocation is the most important

decision an investor makes. While

diversification obviously balances your

risk, it can also increase your returns.

Individuals / Endowments / Trusts / Retirement Funds